Message from the Executive Officer in Charge of Finance and Accounting

I will pursue optimal financial strategies and capital policies that will enable us to reconcile conflicting propositions

Shift from Scale Expansion to a More “Muscular” Business Structure

As a corporate sector director, I make a habit of managing with a sense of balance. In business, we encounter many seemingly opposing values: social value vs. economic value, short-term view vs. long-term view, quantity vs. quality, and investment for growth vs. shareholder returns. Any pair is not necessarily in absolute opposition, and serving both is not just possible, but I would say obligatory. To do so, finding the axis of management is important, and if objectively misaligned or imbalanced, must be repositioned for better balance.

I assumed the responsibility of the Executive Officer in Charge of Finance and Accounting to oversee financial strategies as a whole, including investor relations, in April 2025. In my role, I will pursue balance in addressing various management challenges, and serve seemingly opposing values with an objective, bird’s-eye view. Furthermore, I will promote correcting the management axis according to our financial situation and the assessments of the capital markets.

The past four to five years have been a phase of physical growth for the MGC Group. In other words, we actively took on advance investment to expand volume (scale).

Our depreciation and amortization costs have been growing along with the worldwide surge in costs for plant construction. In addition, R&D expenses for the future have been increasing in line with business portfolio reforms. Therefore, a temporary decrease in profit at each stage is unavoidable.

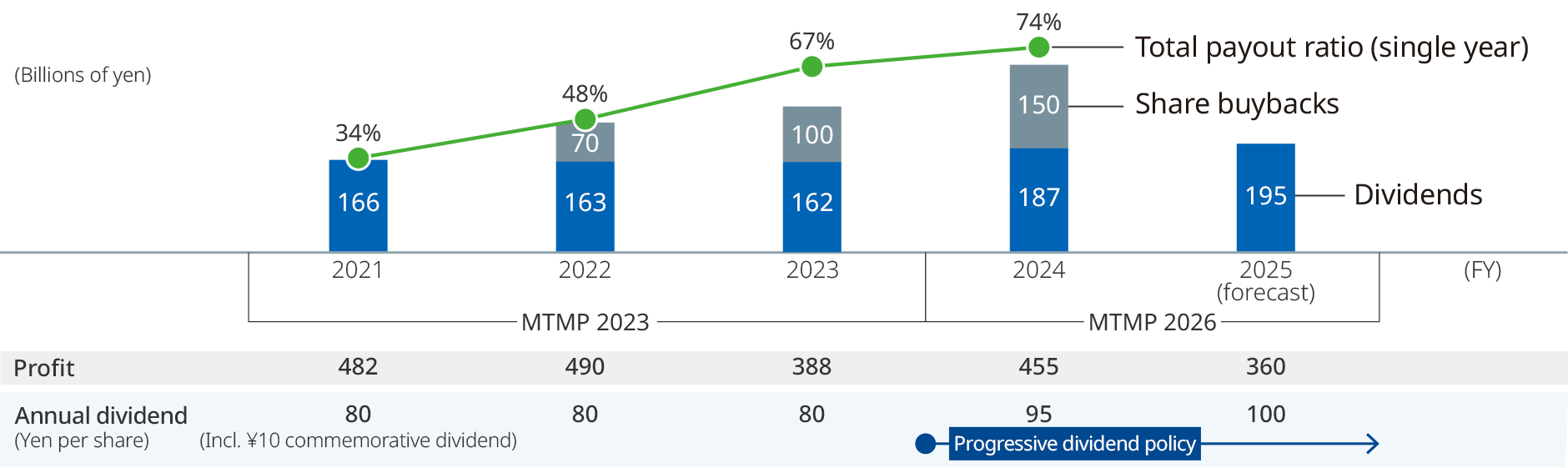

Under these circumstances, we intend to maintain a progressive dividend policy and a total payout ratio of 50% as set forth in the current medium-term management plan (MTMP 2026). It would please us if investors understood this to be evidence of our confidence in achieving solid cash flow in the future.

MTMP 2026 has reached the turnaround point. In other words, we have entered a phase of transition from a phase of expansion to a “muscular” business structure. Going forward, it is important to steadily recoup the growth investments that have been implemented. Under these circumstances, we are paying fresh attention to financial and investment discipline throughout the Group.

Action to Implement Management Conscious of Cost of Capital and Stock Price

Initiatives to strengthen the resiliency of our business portfolio

- Promotion of measures to improve ROIC and ROE

- Focused allocation of management resources to U&P businesses with a focus on the three ICT businesses

- Acceleration of reaping benefits from growth investments

- Thorough price pass-through leveraging high market share

- Acceleration of restructuring of businesses requiring intensive management

- Further thorough cost reduction (not limited to businesses requiring intensive management, but considered across the Group)

- Acceleration of value creation as an R&D-oriented company

- Acceleration of the development and commercialization of new and next-generation businesses, focusing on strategic research areas (mobility, ICT, medical/food)

- Aggressively pursue strategic M&A

Initiatives to reduce cost of capital

- Utilization of financial leverage

- Reduction of performance volatility (concentration on U&P businesses, etc.)

- Promotion of asset lightening

- Promotion of sustainability management

- Strengthening dialogue with investors and analysts, etc.

Initiatives for proactive shareholder returns

(during the period of MTMP 2026)

- Medium-term target of 50% total payout ratio

- Dividend policy in line with the “progressive dividend policy”

- DOE target of 3.0%, etc.

Use Debt Financing to Maintain Investment for Growth with Strict Financial Discipline

In March 2025, Rating and Investment Information Inc. raised its long-term rating of the MGC Group from A to A+. I feel our solid earnings and financial base, built on good business diversification through the growth of the three ICT businesses, has been positively received. We anticipate a certain level of demand for funds, mainly for growth investments, and intend to leverage the financial soundness we have cultivated to make more active use of debt financing to procure funds in the future. Meanwhile, indicators like ROIC and ROE, which show the efficiency of capital and assets, must be further improved.

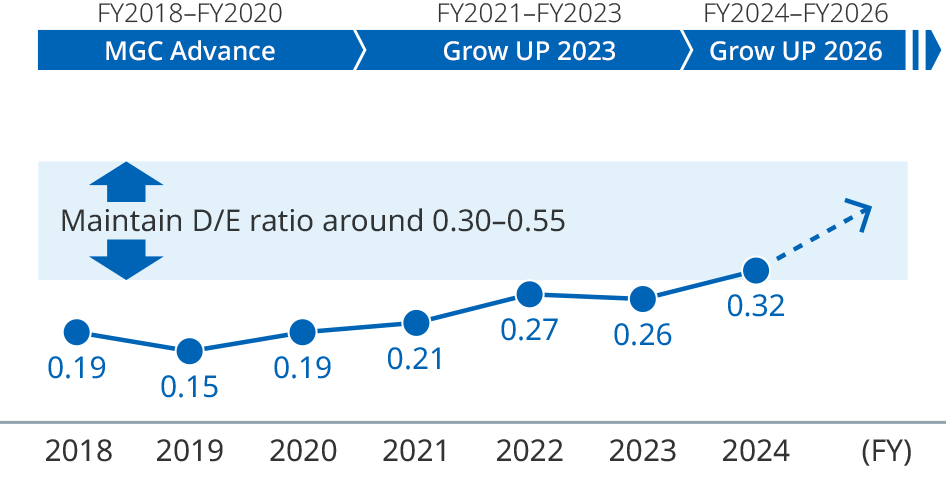

As a KPI to indicate financial health, we use the debt-to-equity (D/E) ratio. MTMP 2026 advocates a policy of controlling the balance sheet by balancing capital efficiency with financial health, targeting a D/E ratio between 0.30 (financial health) and 0.55 (capital efficiency). As mentioned above, we will continue to utilize financial leverage, but at the same time, there is an urgent need to slim items in the left column of the balance sheet, namely assets, while improving their quality. Measures to achieve this include ending strategic shareholdings, selling off assets that are unrelated to our business, and optimizing inventory levels.

It is also essential to enhance dialogue with market participants, and provide feedback to the Group on the opinions and advice we receive. We will further focus on improving corporate value, based on the recognition that the share price and PBR are indicators of shareholder evaluations.

Utilize Financial Leverage for Optimal Capital Structure

- Control the balance sheet through the D/E ratio to strengthen ROIC management. With a view to balancing capital efficiency and financial soundness, a range of around 0.30 to 0.55 is assumed during the period of MTMP 2026

- Aggressively utilize debt financing for various types of investments and loans, considering the current D/E ratio

- Conducted a share buyback of ¥15 billion and cancelled the number of shares bought back (5.55 million shares) in FY2024. As a result, the D/E ratio was 0.32

- Continue to maintain financial discipline and aggressive use of debt financing

Trends in the D/E Ratio (Multiple)

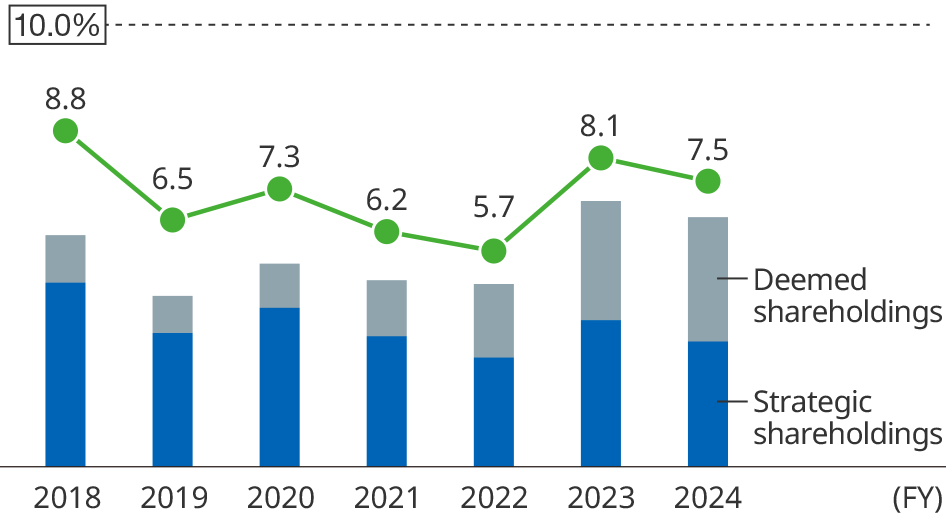

Sale of Strategic Shareholdings

- Five stocks (full sale of two stocks) sold in FY2024, amounting to approximately ¥5 billion

- Despite progress in reducing strategic shareholdings, these occupy a proportion of consolidated net assets that, at the moment, is rising due to the increasing market value of publicly traded shares

- Going forward, our policy is to accelerate the sale of stocks that are deemed to exceed reasonable levels of shareholding, following annual examination of the purpose and meaning of holding individual stocks by the Board of Directors

25 stocks sold over the past seven years (full sale of 17 stocks), cumulative sale of roughly ¥24 billion*1

*1 Based on actual results. Includes partial sale of some shareholdings and sale of deemed shareholdings

Continue Enactment of Proactive Shareholder Returns

- Strengthen shareholder returns in MTMP 2026 by adopting a progressive dividend policy*2 and increasing the total payout ratio*3

- DOE*4 target of 3.0% (during the period of MTMP 2026)

- In FY2024, we implemented a dividend increase (¥15 increase on an ordinary dividend basis), and also carried out a share buyback and cancellation of the shares acquired*5

- The annual dividend for FY2025 is expected to be ¥100 per share (an increase of ¥5 per share on an ordinary dividend basis)

- *2 Covers the three-year period of MTMP 2026. In principle, no reduction—either increase or maintain

- *3 Increase medium-term target from 40% to 50%

- *4 2.83% in fiscal 2024 (actual), 2.90% in fiscal 2025 (forecast)

- *5 Annual dividend increase: Annual dividend for fiscal 2024 of ¥95 per share (interim dividend: ¥45, year-end dividend: ¥50) Share buyback (cancellation): Approximately ¥15.0 billion, 5.55 million shares repurchased, cancellation of all shares repurchased at this time

Going forward, I ask shareholders and investors for their ongoing support of our endeavors.

Motoyasu Kitagawa

Director, Senior Managing Executive Officer

In charge of Internal Control & Risk Management, responsible for Administrative & Personnel,

in charge of Finance & Accounting Division and CSR & IR Division

September 2025