Risk Factors

Business and Other Risks

- 1. Endogenous Business Risk

- 2. Overseas Business Risk

- 3. Joint Venture Risk

- 4. Product Quality Risk

- 5. Natural Disaster and Accident Risks

- 6. Information Security Risk

- 7. Compliance Risk

- 8. Human Rights Risk

- 9. Climate Change Risk

- 10. Investment Risk

- 11. Currency Risk

- 12. Financing and Interest Rate Risks

- 13. Litigation Risk

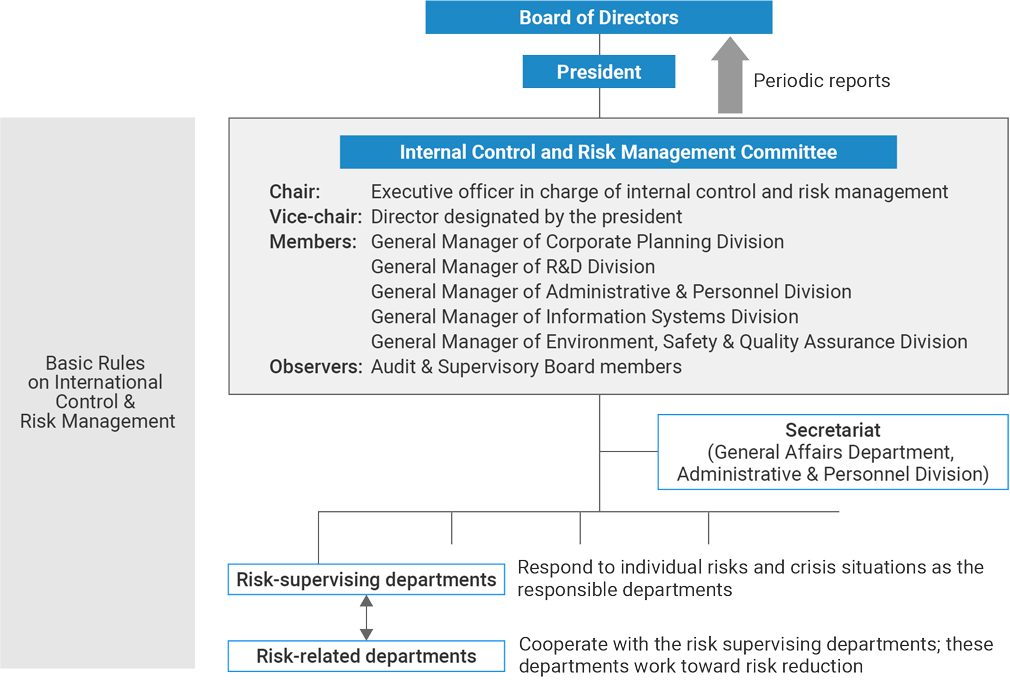

MGC Group defines “risk” as possibilities or hazards that, if they were to manifest, could inflict economic losses on MGC due to human casualties, property damage, reputational damage, opportunity losses or other such detriments. The Group has built a risk management regime designed for both routine and exigent circumstances. Specifically, it has established Basic Rules on Internal Control & Risk Management, formulated risk management/mitigation policies and established an Internal Control & Risk Management Committee chaired by the officer in charge of internal control and risk management as a decision-making body that reports directly to the president. The committee makes decisions on matters related to risk management policies, initiatives and plans; matters related to business and operational risk management and guidance, direction and oversight incidental thereto; and matters related to guidance, direction and oversight related to business continuity planning. Additionally, it periodically reports to the Board of Directors on the state of risk management.

The main foreseeable risks that could affect the Group’s business results, share price, or financial condition are enumerated from 1) through 13) below. They are all risks that the Group deems to be a realistic possibility, though specifics such as the degree and timing of their manifestation and their impacts are impossible to estimate as of the end of fiscal year ended March 31, 2023 (however, they do not necessarily include every risk to which the Group is exposed).

1. Endogenous Business Risk

Nature of Risk

MGC Group is primarily a manufacturer. With many of its products used as raw materials, intermediate goods or pharmaceutical inputs in customers’ business activities, its sales are sensitive to economic conditions, tariff and other trade policies in the countries and regions where its customers’ products are sold, and to the operating environment in its customers’ business areas. In particular, market-priced commodities such as methanol, methanol derivatives, general-purpose aromatic chemicals and polycarbonate resins are generally prone to declines in unit sales and sales prices during economic downturns. Some specialty and high-value-added product markets are also subject to the silicon cycle and other drivers of ebbs and flows in customer demand, and reduced volumes could adversely affect the Group’s operating results and/or financial condition.

In specialty and high-value-added product markets, the Group competes on multiple dimensions, including price, quality, functionality, delivery time and customer service. Intensification of competition due to, for example, the advent of products offering alternative functionality, could adversely affect the Group’s operating results and/or financial condition. For example, products that are supplied mainly to the electronics industry, which includes advanced semiconductors, typically have a short product lifecycle and are constantly exposed to competition through technological innovation. The Group’s sales consequently could decline as a result of existing products’ obsolescence or product development delays. Additionally, some of the Group’s products are sold to only a limited number of customers. If one customer stops using such a product, the Group’s sales could decrease.

MGC Group externally sources electric power and raw materials like xylene, uses external services such as logistics and so on for distribution, and is constantly performing maintenance on existing production facilities and installing new equipment. Its manufacturing operations could be disrupted if a required input, material, facility, or service were to become unavailable. Its operating results and/or financial condition could be adversely affected by a sharp rise in input prices also.

MGC business is supported by the efforts of a diverse and large number of employees working in various fields, including research and development, manufacturing, sales, logistics, planning, and management. Due to factors such as workforce mobility, the declining birthrate and aging population in Japan, and the rapid rise in economic standards overseas, securing such human resources may become difficult both domestically and internationally. Additionally, if the labor costs and other related burdens required for this increase excessively, it could potentially have an adverse impact on the performance and financial condition of our group.

Main Risk Mitigation Measures

In order to achieve further improvements in productivity, MGC Group endeavors to develop new, high-added value markets and businesses as well as conducting basic and applied research to develop new products and manufacturing processes and improve existing ones. Other risk mitigation measures include close communication and collaboration, inclusive of R&D, with customers, use of long-term supply contracts with both suppliers and customers, and sourcing of raw materials and other inputs from multiple suppliers. In addition, regarding potential future logistics risks such as transportation capacity shortages, we are working on reviewing logistics methods and systems to address these challenges.

We are working to utilize IT systems and other new technologies to improve productivity not only in manufacturing operations but in all the business activities of MGC Group. In order to secure human resources, we create workplace environments in which employees mutually respect each other’s individuality, and in which they can fully participate and grow as people. To this end we are working to nurture an invigorated culture of collaboration between individuals with diverse values that is of new ideas and technological innovation and establishing dedicated departments in addition to implementing various other measures.

2. Overseas Business Risk

Nature of Risk

MGC Group sources, manufactures, and sells either directly from Japan or through its subsidiaries in Asia, North America, South America, the Middle East and elsewhere. Depending on country-specific conditions or the geopolitical situation, such overseas operations and funds or dividend remittances from overseas subsidiaries could be disrupted by political instability or societal or economic turmoil due to a natural disaster, war, infrastructure failure, a widespread infectious disease outbreak or other unforeseeable circumstances. Other risks that could adversely affect the Group’s operating results and/or financial condition include problems due to differences in legal systems, investment restrictions imposed by foreign governments, nationalization or expropriation of assets, and personnel or labor issues.

Main Risk Mitigation Measures

To respond to overseas risks as effectively and expeditiously as possible, while monitoring the latest developments in the global situation, MGC Group endeavors to gather information from various sources, including locally stationed expat personnel, joint venture partners, attorneys and government authorities. MGC Group works to tailors its response to the specifics of each business or region in order to achieve its objectives, which include ensuring the safety of those working locally.

3. Joint Venture Risk

Nature of Risk

MGC Group has numerous manufacturing joint ventures in not only Japan but also foreign countries such as Saudi Arabia, Venezuela, Thailand, China, South Korea, and Trinidad and Tobago. It sources and sells products such as methanol and engineering plastics through its joint ventures. The Group’s joint venture partners are not under the control of the Group. There is consequently no assurance they will make decisions in the best interests of the Group or even the joint ventures themselves. In the event of a joint venture’s dissolution or other such circumstances, the Group’s operating results and/or financial condition could be adversely affected.

Main Risk Mitigation Measures

MGC Group seeks to maintain and further improve good communication, share targets and objectives and maintain relationships with its joint venture partners while mitigating risks through joint venture agreements and other operational agreements.

4. Product Quality Risk

Nature of Risk

As noted above, MGC Group manufactures many products that are used as raw materials, intermediate goods or pharmaceuticals in customers’ business activities and that conform to specifications agreed upon with the customer. Some of our products are used for raw materials of food etc. If it sells a qualitatively defective product, it may have to compensate customers that used the defective product, end-product users and/or other parties for not only direct damages but also opportunity losses. Its societal reputation also may be impaired. In such an event, the Group’s operating results and/or financial condition could be adversely affected.

Main Risk Mitigation Measures

Even though most MGC Group manufacturing sites operate in conformance with globally recognized quality control standards, the Group has liability insurance coverage that includes product liability insurance as a precaution against risk. Other means by which the Group mitigates risk include explicitly limiting the scope of its liability as necessary in agreements with customers.

5. Natural Disaster and Accident Risks

Nature of Risk

MGC Group has numerous manufacturing sites in Japan and elsewhere. Their production activities could be disrupted by earthquakes, storms, flooding or other natural disasters, war, terrorism, civil unrest, labor actions, communication infrastructure failures, lockdowns and other measures taken in response to outbreaks of infectious diseases, equipment malfunctions, human error or other unforeseeable circumstances. Given that MGC Group handles hazardous chemical substances on a daily basis, it cannot completely eliminate the possibility of explosions, fires, toxic gas leaks or other accidents that damage production facilities, harm employees, inflict losses on neighboring property owners or customers, pollute the environment or otherwise inflict damages. Additionally, many MGC Group manufacturing sites have multiple production facilities that share utilities such as electricity, water and steam. Interruption of utility service to a manufacturing site consequently could shut down the site’s entire production operations. In such an event, the Group’s operating results and/or financial condition could be adversely affected.

Main Risk Mitigation Measures

While pursuing continuous improvement based on the promotion of Responsible Care activities as part of its comprehensive environmental safety management, MGC Group diligently strives to upgrade its safety and disaster preparedness regime through better risk assessment and thorough safety training. In addition to, of course, endeavoring to maintain and ensure stable operation of its manufacturing facilities, the Group also formulates business continuity plans and builds redundancy into its network of production sites, including those overseas. Additionally, the Group mitigates risk with broad insurance coverage that includes fire, business interruption, oil pollution and liability insurance.

Measures taken to improve productivity, such as the usage of online video conferencing throughout the Group, also contributed to initiatives to address the spread of infectious disease. In addition to continuing their use going forward, we will customize thoroughgoing measures to be ready for infection to specific operations, on a workplace-by-workplace basis.

6. Information Security Risk

Nature of Risk

MGC Group possesses confidential and personal information required for its business activities and uses various information systems in its operations amid ongoing digitalization of its businesses. In the event of a leak of such information, an information system failure, a cyberattack, fraud committed by a malicious third-party or other such event, the Group’s business activities and/or operating results could be adversely affected.

Main Risk Mitigation Measures

MGC Group has established an information security regime and internal regulations based on various guidelines and educates its employees to increase their information-security literacy. It also conducts ongoing initiatives to ensure the adequacy of and upgrade its information security.

7. Compliance Risk

Nature of Risk

MGC Group handles toxic and otherwise hazardous chemical substances, including high-pressure gases, as an inherent aspect of its operations. As such, it is globally subject to various legal and regulatory restrictions at every stage from manufacturing to storage, distribution and sales. In all its business activities and transactions, the Group is required to not only comply with laws and regulations but also to fulfill social responsibilities that are not limited to such rules. However, in the event that an infringement of laws and, regulations, or social norms, including the rules described above, is deemed to have occurred, the Group’s operating results and/or financial condition could be adversely affected as a result of incurring legal liability and rectification costs, social sanctions and loss of trust.

Main Risk Mitigation Measures

In addition to establishing specialized organizational units to oversee environmental and other regulatory compliance, MGC Group has built a compliance regime, including an internal whistleblowing system, and endeavors to fully comply with laws and regulations. It also implements various measures to foster a general compliance consciousness among its personnel.

The Group takes a broad view of compliance, one that involves not only abiding by laws but also upholding the fair, transparent, and flexible conduct of business, while respecting social and other norms, in acknowledgment of its responsibilities to society, and makes this known to all employees.

8. Human Rights Risk

Nature of Risk

Awareness of human rights continues to increase, primarily in developed nations, and companies are now being required to make efforts at a global level to respect and protect human rights in the course of business, including the supply chain. In the event that the Group does not address these issues appropriately, the Group’s operating results and/or financial condition could be adversely affected by not only legal and regulatory responsibility but also the termination of transactions, social sanctions, and loss of trust.

Main Risk Mitigation Measures

The MGC Corporate Behavior Principles and the MGC Group Code of Conduct have long called for respect for human rights, and the Group has been also a signatory of the UN Global Compact. Furthermore, in response to the growing social awareness of human rights in recent years, we established Mitsubishi Gas Chemical Group Human Rights Principle and organized interdepartmental committee to deal with respect for human rights. For instance, MGC promotes responsible business, which includes protection of human rights, through such actions as showing the “Mitsubishi Gas Chemical CSR Procurement Guidelines” and other documents to its supply chain partners in order to gain their understanding and cooperation.

9. Climate Change Risk

Nature of Risk

MGC Group recognizes that climate change caused by greenhouse gases emitted in the course of its business and other activities, and a variety of related changes that occur in the natural and business environments constitute material risk factors. In the event that the Group’s initiatives to address greenhouse gas emissions are inadequate, social sanctions and loss of trust may result. In addition, for example, if various emissions control measures are introduced, such as new carbon taxes or emissions trading systems, the Group’s operating results and/or financial condition could be adversely affected.

Main Risk Mitigation Measures

In May 2019, MGC declared its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Risks and opportunities posed to MGC Group by climate change are examined by an advisory body attended by general managers of the head office’s corporate sector, based upon which they are reviewed and approved by a Sustainability Promotion Council chaired by MGC’s president and comprised primarily of directors, including outside directors, but also attended by audit & supervisory board members and others.

In addition to mitigating risks due to climate change through analyses based on decarbonization scenarios and scenarios in which no specific action is taken, the Group will strengthen its resilience to be better able to transform risks into business opportunities.

By developing existing MGC businesses with strengths in carbon-neutral initiatives and leveraging R&D capabilities, we are promoting the use of electricity generated from LNG, which has low greenhouse gas emissions, and the adoption of renewable energy in the transition stage, while working in collaboration with other MGC Group businesses and external entities. Going forward, we will take specific steps toward helping to achieve carbon neutrality by 2050 in the form of establishing and installing a variety of carbon-free energy systems, CCUS, and recycling systems.

10. Investment Risk

Nature of Risk

MGC Group invests in capital assets and R&D to grow its businesses and increase its competitiveness. In doing so, it focuses its efforts on strengthening existing businesses and developing new businesses aligned with prospective market needs. The Group also invests and intends to continue investing in business expansion in Japan and overseas through such means as establishing or co-founding new companies, including joint ventures, and acquiring existing companies.

If the Group fails to earn adequate returns on such investments or if the value of securities that it holds declines significantly, leading to impairments on non-current assets, securities valuation losses or equity-method investment losses, its operating results and/or financial condition could be adversely affected.

Main Risk Mitigation Measures

MGC Group has established and carries out internal investment screening procedures and performs additional due diligence as warranted by the nature of the prospective investment. Additionally, involved organizational units endeavor to devise appropriate risk mitigation measures.

11. Currency Risk

Nature of Risk

Export, import, and other transactions denominated in foreign currencies could adversely affect MGC Group’s operating results and/or financial condition, including by reducing sales revenues or exacerbating losses, as a result of exchange rate movements.

Additionally, financial statement accounts denominated in the Group overseas subsidiaries’ local currencies are translated into yen to prepare MGC’s consolidated financial statements. Such currency translation could adversely affect the Group’s operating results and/or financial condition depending on then-prevailing exchange rates.

Main Risk Mitigation Measures

MGC Group partially hedges currency risk associated with foreign-currency receivables and payables, mainly using currency forward contracts, in accord with internal regulations.

12. Financing and Interest Rate Risks

Nature of Risk

MGC Group partially meets its financing needs by borrowing from financial institutions. In the event of a precipitous change in the financial environment, the Group’s operating results and/or financial condition could be adversely affected, including by inability to access funding or increased interest expense due to a rise in interest rates.

Main Risk Mitigation Measures

MGC Group strives to maintain adequate financial soundness as measured by indicators such as debt/equity ratio and shareholders’ equity ratio. It also endeavors to optimize its mix of fixed- and variable-rate debt and maintain healthy, favorable relationships with financial institutions and other sources of capital.

13. Litigation Risk

Nature of Risk

In the event of an unfavorable outcome to litigation or other legal proceedings brought against MGC Group in connection with its domestic or overseas operations, the Group’s operating results and/or financial condition could be adversely affected. For example, the Group seeks to protect its intellectual property through such means as applying for and obtaining patents in Japan and overseas. It also endeavors to avoid infringing on other parties’ rights. However, if litigation pertaining to intellectual property rights was to be decided against MGC, the Group’s operating results and/or growth could be adversely affected.

Main Risk Mitigation Measures

MGC Group endeavors to not only comply with all laws and regulations applicable to its operations but also avoid disputes through such means as researching other parties’ rights and drafting proper agreements that explicitly delineate rights and obligations with the assistance of attorneys and other expert advisors.