Medium-Term Management Plan Grow UP 2026

Vision for MGC in 2030

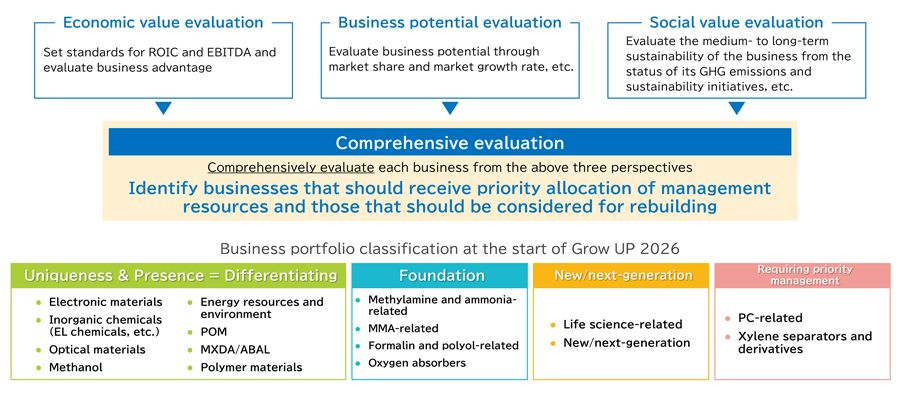

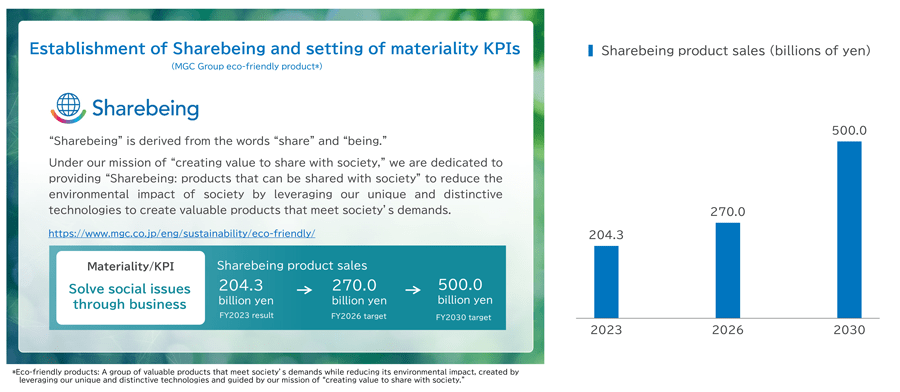

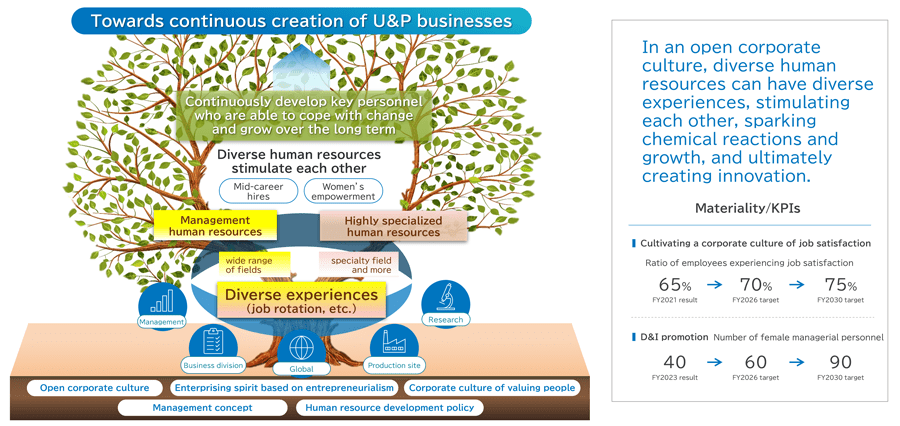

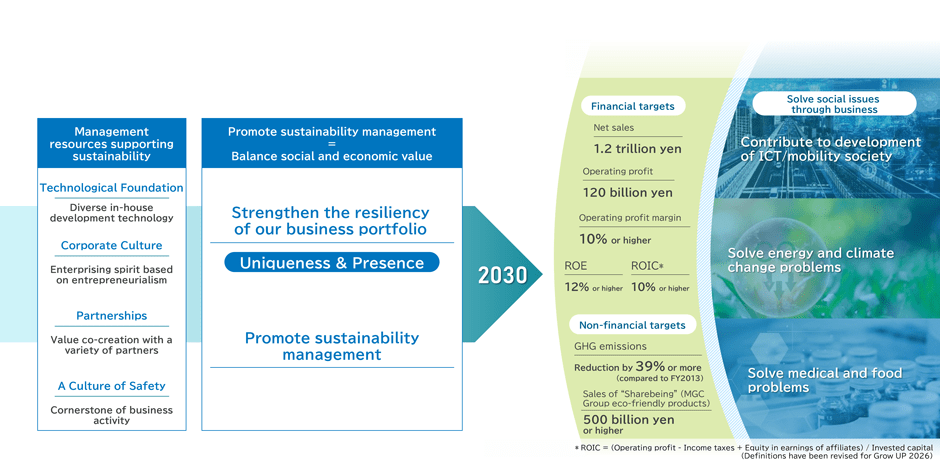

- Sharpen businesses defined by “Uniqueness & Presence,” and contribute to solving social issues through business

- For 2030, we aim to achieve net sales 1.2 trillion yen, operating profit of 120 billion yen, operating profit margin of 10% or higher, ROE of 12% or higher, and ROIC of 10% or higher

Grow UP 2026 Objectives and Strategies

Grow UP 2026

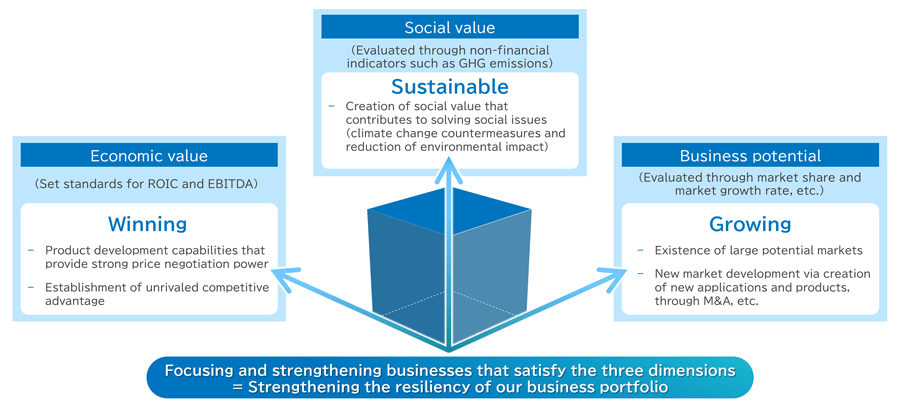

— “Growing," “Winning," and “Sustainable“

Plan Duration: Three years from FY2024 to FY2026

Positioning: Successor to Grow UP 2023; period that contributes to the realization of the vision for MGC in 2030

Retackling previous plan targets and aiming for even higher goals as “an excellent company with uniqueness and presence built on chemistry.”Keywords: Uniqueness & Presence

Improvement of Capital Profitability

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

- The Group envisages the shareholders’ equity cost at around 6.5% to 7.5%* and the cost of capital at around 5.0% to 6.0%*

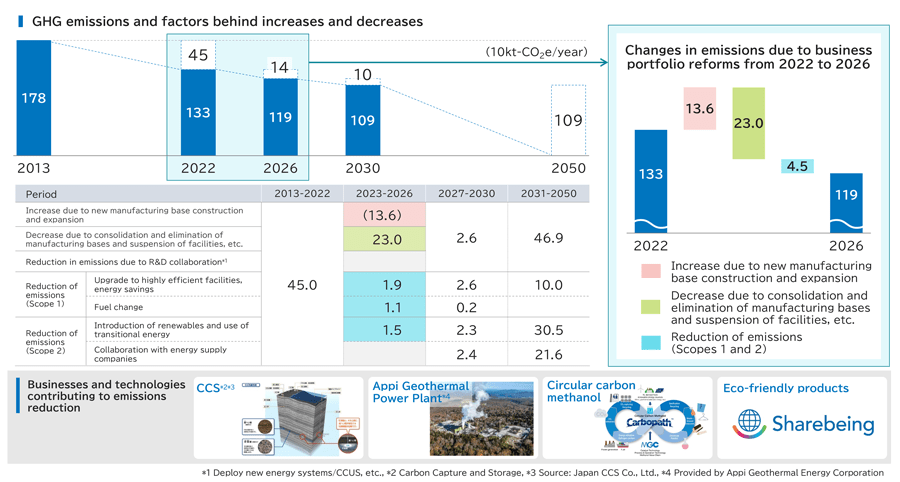

- We intend to increase both ROE and ROIC by strengthening the resiliency of our business portfolio and undertaking the following initiatives to reduce the cost of capital

- *CAPM basis

Initiatives to Reduce the Cost of Capital

- Shift to U&P businesses, use growing earnings stability to reduce volatility

- Strengthening of balance sheet control (financial leverage utilization, etc.)

- Enhance cash-generating capabilities (CCC improvement, review and sale of redundant or low-performing assets, etc.)

- Promote sustainability management (shift to carbon-neutral businesses, improve ESG evaluation, etc.)

- Enhance appeals to individual investors, etc.

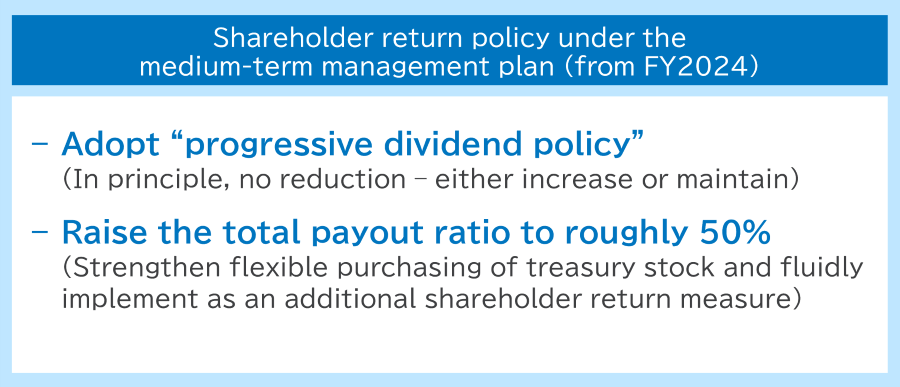

Shareholder Return Policy

- Enhance shareholder returns through the medium-term management plan. Introduce progressive dividends* and raise the total payout ratio from about 40% to roughly 50%

- *Covers the three-year period of the medium-term management plan. Annual dividends will be maintained or increased from a minimum of 90 yen per share.

Grow UP 2026 Numerical Targets

| FY2023 Result | FY2026 Target | Difference | |

|---|---|---|---|

| Net sales (billions of yen) |

813.4 | 850.0 | +36.6 |

| Operating profit (billions of yen) |

47.3 | 85.0 | +37.7 |

| Operating profit margin | 5.8% | 10% or higher | +4.2pp |

| Ordinary profit (billions of yen) |

46.0 | 95.0 | +49.0 |

| EBITDA*1 (billions of yen) |

84.9 | 150.0 | +65.1 |

| ROE | 6.1% | 9% or higher | +2.9pp |

| ROIC*2 | 3.3% | 8% or higher | +4.7pp |

- *1 EBITDA = Ordinary profit + Interest paid + Depreciation and amortization

- *2 ROIC = (Operating profit - Income taxes + Equity in earnings of affiliates) / Invested capital (Definitions have been revised for Grow UP 2026)