Corporate Governance

Mitsubishi Gas Chemical Company, Inc. (MGC) strives to operate effective corporate governance systems, and continuously reinforce and enhance those systems, considering the Corporate Governance Code established by the Tokyo Stock Exchange. MGC also discloses reports on its corporate governance policies and related systems. This corporate governance report is also revised when necessary.

Fundamental Approach to Corporate Governance

Approach

The Company believes that meeting the expectations of all stakeholders, beginning with our shareholders, means working to increase corporate value through business activities and contributing to the realization of a sustainable society, with the aim of achieving both social and economic value under its Mission of “creating value to share with society.” To this end, the Company strives to operate effective corporate governance systems, and continuously reinforce and enhance those systems.

Basic Policies

- (1) Ensure the rights of and equality among shareholders.

- (2) Engage in appropriate collaboration with shareholders and other stakeholders.

- (3) Conduct appropriate information disclosures and maintain transparency.

- (4) Properly carry out the responsibilities of the Board of Directors and other bodies.

- (5) Engage in constructive dialogue with shareholders.

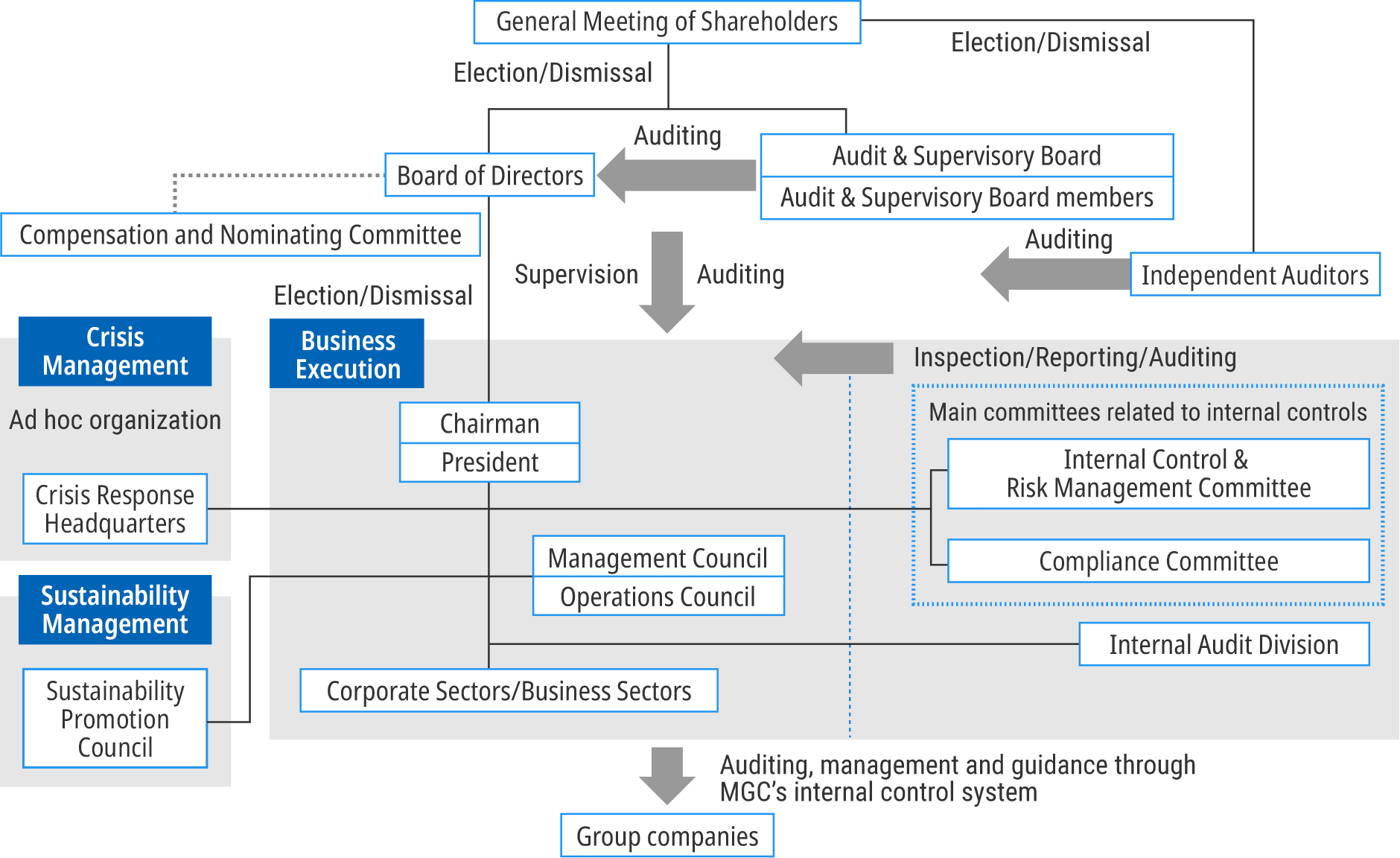

Corporate Governance System

The Company has elected to have an Audit & Supervisory Board. The Company has, for the purpose of business execution, established an executive officer system that clearly separates management decision-making and supervisory functions from the business execution function.

For matters arising in the course of business execution that may have a significant effect on the Company, the Board of Directors makes its decisions on the basis of multifaceted deliberations, including deliberations on management policies by the Management Council and deliberations on plans for executing specific policies by the Operations Council.

The Board of Directors receives advice from attorneys and other experts when necessary in the course of its decision making and supervision of business execution.

To ensure the transparency, objectivity and reasonableness of the Company’s decision-making processes for Directors and executive officers’ compensation and Director, Audit & Supervisory Board Member and executive officer nominations/appointments, the Board of Directors consults with the Compensation and Nominating Committee, majority of which is comprised of independent outside Directors, before any compensation or nomination/appointment proposal is placed on a Board of Directors’ meeting agenda. The Compensation and Nominating Committee comprises independent outside Directors in addition to the Board of Directors’ chairman and the Company’s president.

| Organizational Format | Company with an Audit & Supervisory Board |

|---|---|

|

|

| Composition of the Audit & Supervisory Board | Five (of which three are outside Audit & Supervisory Board Members) |

| Number of Independent Officers | Seven |

|

|

| Introduction of a Hostile Takeover Defense Plan | None |

Assessment and Evaluation of Board of Directors’ Effectiveness

Every year, we conduct assessments on the effectiveness of the Board of Directors. As a new approach starting from the assessment for FY2023, we appointed a third-party organization and utilized its expert knowledge in discussion and collating the survey items, and so forth. We plan to continue appointing it every three years or so.

The perspective for the survey consists five aspects: “Composition and operation of the Board of Directors,” “Management strategy and business strategy,” “Corporate ethics and risk and crisis management,” “Performance monitoring and management team assessment,” and “Dialogue with shareholders, etc.” In April 2025, we conducted a survey of all Directors and Audit & Supervisory Board Members, which presented various kinds of questions using a five-point scale, which were based on the survey aspects, and requested opinions from a free perspective unrestricted by the parameters of the five-point scale. The Board of Directors then held discussions based on the aggregate results and opinions that were received.

In the results of that survey, the average score on the five-point scale for all items was above “4: More effective and appropriate than not.” Moreover, the majority of the assessments were positive. As such, the Company recognizes that the Board of Directors has achieved a certain level of effectiveness. In particular, the scores were relatively high for the items “Composition of the members of the Board of Directors” and “Dialogue with shareholders, etc.”, and multiple comments offering a positive assessment of them were observed. In addition, “Increasing corporate value through response to issues related to sustainability” has maintained a high score from the previous fiscal year.

On the other hand, based on the discussion in the Board of Directors, we will undertake a necessary review, primarily with respect to elements such as those for which it was indicated that there exists room for improvement. In doing so, we will be aiming to ensure a more effective Board of Directors and continue to go about strengthening and improving it as an organization.

| Measures for Issues Considerred and Adopted in FY2024 |

・To prevent a time lag between the recognition of risk on the front line and reporting of it to the Board of Directors, we are utilizing not only the Board of Directors, as a space for deliberation, but also opportunities such as prior briefings for outside Directors and Audit & Supervisory Board Members and reports on the status of execution of duties by Directors. |

|---|---|

| Main Themes Deliberated in Fiscal 2024 |

・Formulation of current medium-term management plan (MTMP 2026) (quantitative part) |

| Issues and Measures in FY2025 |

・Strategy monitoring |

Compensation and Nominating Committee

The Compensation and Nominating Committee functions both to determine executive officer compensation and to nominate and appoint key members of the management team. The majority of the committee is comprised of independent outside Directors. The Board of Directors is responsible for appointing and dismissing key members of management, including the Chairman and President, and for nominating Directors and Audit & Supervisory Board Members. In making decisions on policies regarding executive officer compensation and total annual amounts, and in determining allocation of those amounts, the Compensation and Nominating Committee is consulted prior to those matters being put before the Board of Directors for discussion.

Note that the appointment, dismissal and nomination of said officers are judged in light of certain selection criteria that include whether they have the appropriate internal and external work experience and knowledge for the position; whether they have the dignity and ethical values appropriate to their responsibilities; and whether they have violated any laws, the Articles of Incorporation, or company rules.

Training of Directors and Audit & Supervisory Board Members

The Company gives Directors, when deemed necessary, Audit & Supervisory Board Members opportunities to attend external seminars covering various topics, including compliance, risk management, internal control, and legal issues, and provides them with relevant books and other materials in order to enhance their understanding of the roles, responsibilities, and duties of their respective positions.

Moreover, outside Directors and outside Audit & Supervisory Board Members will be provided with opportunities including explanations by each business unit of its operations and duties, business observations, and company status briefings for important subsidiaries.

In addition, MGC works to improve the efficacy and quality of its auditing by organizing study meetings for members of the Audit & Supervisory Board and by providing opportunities for them to attend external seminars of their choosing in order to gain additional knowledge of relevant laws, auditing techniques, financial accounting, and other matters.

Information Sharing and Support Network for Audit & Supervisory Board Members

The full-time Audit & Supervisory Board Members endeavor to stay informed of important decision-making processes and the state of business execution through such means as attending important meetings, including Operations Council meetings in addition to Board of Directors meetings, auditing individual organizational units, surveying subsidiaries and reviewing key documents.

Audit & Supervisory Board Members regularly exchange views with Directors, periodically and promptly receive reports on the status of business execution and other important matters from Directors and office staff, request explanations whenever necessary, and express opinions.

Additionally, the Audit & Supervisory Board Members endeavor to improve audit effectiveness through such means as coordinating with the independent auditor and Internal Audit Division and attending Internal Control & Risk Management Committee and Compliance Committee meetings.

One staff member is assigned exclusively to assist Audit & Supervisory Board Members, including outside members, with their duties as directed by them. Audit & Supervisory Board Members are authorized to engage the services of external experts at the Company’s expense.

Introduction of Diverse Perspectives

MGC has developed a global business that ranges widely from basic chemicals to high-performance materials. Because our management decisions require a high degree of expertise, the Board of Directors as a whole strives to maintain a well-balanced diversity of knowledge, experience, and abilities, centered on those from within the Company who are deeply familiar with our business and management, with the addition of multiple independent Directors who, representing the perspectives of shareholders and other stakeholders, provide advice and supervision.

The Company currently has 12 Directors(of whom four are independent outside Directors, and three-quarters of them are women outside Directors), which we believe to be generally appropriate in size and effectiveness.

In order to ensure the fair and objective oversight of management, particular attention is paid to the independence of outside officers (outside Directors and outside Audit & Supervisory Board Members), in accordance with criteria set by the Tokyo Stock Exchange regarding independence. MGC appoints only candidates who have no conflict of interest with general shareholders.

The Company nominates as independent all outside officers who satisfy the requirements for being an independent officer.

-

Detail

Criteria Regarding Independence of Outside Officers

Candidates are deemed to qualify as an independent officer as long as none of the following apply:

- If any of the following applies to the candidate:

- Has been a business execution manager*1 of the Group*2.

- Is a major shareholder*3 of MGC or is or has been a business execution manager for a major shareholder company within the previous five years.

- Is or has been a business execution manager of an important business partner*4 within the previous five years.

- Has been dispatched from a company or organization that has established a relationship with the Group through the reciprocal appointment of outside officers.

- Works for or has worked for an auditing firm within the previous five years that has conducted a statutory audit of MGC.

- Provides or has provided consulting services other than statutory auditing to the Group within the previous three years, for which he or she has received high compensation.*5

- If any of the following applies to a close relation*6 of the candidate:

- Is or has been an important business execution manager*7 of the Group within the previous five years.

- Is a major shareholder of MGC or a business execution manager for a major shareholder company.

- Is or has been a business execution manager within the previous five years of an important business partner.

- Works for or has worked for an auditing firm within the previous five years that has conducted a statutory audit of MGC.

- Provides or has provided consulting services other than statutory auditing to the Group within the previous three years, for which he or she has received high compensation.

- The candidate has another important vested interest in the Group and has been reasonably deemed to be unable to fulfill his or her duties as an independent officer.

- *1 Business execution manager: Either a Director overseeing business execution, an executive officer, other officer involved in business execution, or an employee

- *2 The Group: MGC or one of its subsidiaries

- *3 Major shareholder of MGC: A shareholder currently holding, either directly or indirectly, 10% or more of total shares issued and outstanding

- *4 Important business partner: A business partner that has made transactions, including buying and selling, amounting to 2% or more of consolidated net sales over the previous three consecutive years. Consolidated net sales pertain to the Group in the event the Group is the seller, or to the partner in the event the Group is the buyer.

- *5 High compensation: In the case of an individual, an annual amount of 10 million yen or more, or in the case of a member of company or organization, compensation exceeding 2% of its consolidated net sales or total revenue

- *6 Close relation: Either a spouse, first- or second-degree relative, or financial dependent

- *7 Important business execution manager: Either a Director overseeing business execution, an executive officer, or other officer involved in business execution

- If any of the following applies to the candidate:

| Name | Independent officer | Reasons for appointment | Attendance at Board of Directors meeting (FY2024) | |

|---|---|---|---|---|

| Yasushi Manabe | Yes |

Mr. Yasushi Manabe has many years of experience and insight as a manager at a company operating on a global scale, and provides appropriate supervision and advice to MGC’s management including actively expressing his opinions based on these at the Board of Directors. So, he is expected to continue to contribute to ensuring the validity and appropriateness of MGC’s decision-making. |

Board of Directors | Attended 12 of 12 meeting (100%) |

| Kazue Kurihara | Yes |

Dr. Kazue Kurihara has highly advanced expertise in wide fields of study in chemicals, and provides appropriate supervision and advice to MGC’s management including actively expressing her opinions based on these at the Board of Directors. So, she is expected to continue to contribute to ensuring the validity and appropriateness of MGC’s decision-making. |

Board of Directors | Attended 12 of 12 meeting (100%) |

| Kuni Sato | Yes |

Ms. Kuni Sato has many years of experience overseas and insight, and it is deemed that she would provide appropriate supervision and advice to MGC’s management from such perspective, and it is expected that she would contribute to ensuring the validity and appropriateness of MGC’s decision-making in the future. |

Board of Directors | - |

| Mihoko Manabe | Yes |

Ms. Mihoko Manabe has many years of experience overseas and also possesses a considerable degree of knowledge regarding finance and accounting at a global company, and it is deemed that she would provide appropriate supervision and advice to MGC’s management from such perspective, and it is expected that she would contribute to ensuring the validity and appropriateness of MGC’s decision-making in the future. |

Board of Directors | - |

| Name | Independent officer | Reasons for appointment | Attendance at Board of Directors meeting (FY2024) | |

|---|---|---|---|---|

| Go Watanabe | Yes |

Mr. Go Watanabe has abundant experience and insight as a manager at a financial institution and a manufacturing industry etc., both in Japan and overseas, and has considerable expertise in finance and accounting. Therefore, he is suited for an outside Audit & Supervisory Board Member to be responsible for ensuring the lawfulness and appropriateness of the execution of Directors' duties. |

Board of Directors | Attended 12 of 12 meeting (100%) |

| Audit & Supervisory Board | Attended 14 of 14 meetings (100%) | |||

| Tsuneaki Teshima | Yes |

Mr. Tsuneaki Teshima has many years of experience and insight as a manager at a financial institute, and has considerable expertise in finance and accounting. Therefore, he is suited for an outside Audit & Supervisory Board Member to be responsible for ensuring the lawfulness and appropriateness of the execution of Directors' duties. |

Board of Directors | Attended 9 of 9 meeting (100%) |

| Audit & Supervisory Board | Attended 9 of 9 meetings (100%) | |||

| Mayako Perez Takahashi | Yes |

Ms. Mayako Perez Takahashi has abundant experience at auditcorporations etc., and also possesses a considerable degree of knowledge regarding finance and accounting. Therefore, she is suited for an outside Audit & Supervisory Board Member to be responsible for ensuring the lawfulness and appropriateness of the execution of Directors' duties. |

Board of Directors | - |

| Audit & Supervisory Board | - | |||

The Board of Directors as a whole strives to maintain a well-balanced diversity of knowledge, experience, and abilities.

Masashi Fujii

Masashi Fujii Yoshinori Isahaya

Yoshinori Isahaya Motoyasu Kitagawa

Motoyasu Kitagawa Ryozo Yamaguchi

Ryozo Yamaguchi Ko Kedo

Ko Kedo Hideaki Akase

Hideaki Akase Tomoyuki Azuma

Tomoyuki Azuma Chika Kobayashi

Chika Kobayashi Yasushi Manabe

Yasushi Manabe Kazue Kurihara

Kazue Kurihara Kuni Sato

Kuni Sato Mihoko Manabe

Mihoko Manabe Go Watanabe

Go Watanabe Masato Inari

Masato Inari Nobuhisa Ariyoshi

Nobuhisa Ariyoshi Tsuneaki Teshima

Tsuneaki Teshima Mayako Perez Takahashi

Mayako Perez Takahashi

| Corporate management/ Industry expertise |

Production technology / R&D / Environment safety |

Business strategy / Sales / Market development |

Finance / Accounting / Management planning |

Legal / Compliance / Risk management |

HR / Labor / Talent development |

Global / Diversity / Experience in other sectors |

|

|---|---|---|---|---|---|---|---|

| Directors | |||||||

| Masashi Fujii |

○ | ○ | ○ | ○ | |||

| Yoshinori Isahaya |

○ | ○ | ○ | ○ | |||

| Motoyasu Kitagawa |

○ | ○ | ○ | ○ | |||

| Ryozo Yamaguchi |

○ | ○ | ○ | ○ | |||

| Ko Kedo |

○ | ○ | ○ | ○ | |||

| Hideaki Akase |

○ | ○ | ○ | ○ | |||

| Tomoyuki Azuma |

○ | ○ | ○ | ○ | |||

| Chika Kobayashi |

○ | ○ | ○ | ○ | |||

| Yasushi Manabe |

○ | ○ | ○ | ||||

| Kazue Kurihara |

○ | ○ | ○ | ||||

| Kuni Sato |

○ | ○ | ○ | ||||

| Mihoko Manabe |

○ | ○ | ○ | ||||

| Audit & Supervisory Board Members | |||||||

| Go Watanabe |

○ | ○ | ○ | ○ | |||

| Masato Inari |

○ | ○ | ○ | ○ | |||

| Nobuhisa Ariyoshi |

○ | ○ | ○ | ○ | |||

| Tsuneaki Teshima |

○ | ○ | ○ | ||||

| Mayako Perez Takahashi | ○ | ○ | ○ | ||||

- ※ Up to four high-priority areas of expertise/experience are noted for each individual.

The table above is not exhaustive with respect to the expertise and experience disclosed for each individual.

Compensation of Directors and Audit & Supervisory Board Members

Policies and Methods for Determining Compensation to Directors

Annual compensation consists of a fixed basic compensation based on the individual’s position and responsibilities, and performance-based compensation that takes into account various indicators of the Company’s performance. Compensation is divided into monthly installments and paid monthly, and a certain percentage is accumulated annually as a reserved retirement benefit to be paid at the time of retirement. This amount may be subject to reduction based on the individual’s performance and other factors.

Performance-based compensation is intended to be an incentive for overall Company performance of a fiscal year, and is determined using financial indicators such as ordinary income, ROE and ROIC, based on actual results, level of achievement, and so on. In addition, to further promote sustainability management, from fiscal 2025, we will also take into consideration non-financial indicators (ESG indicators) such as GHG emission reduction rates, the percentage of employees who feel a sense of fulfillment in their work, and compliance status, when determining the compensation.

Restricted stock compensation is compensation paid to Directors once each fiscal year in the form of grants of Company stock; Directors are granted a certain number of shares based on their positions and responsibilities. The purpose of restricting transfers of these shares and having recipients hold them for a certain period of time is to share value with shareholders and provide an incentive for working toward medium- to long-term sustained growth of corporate value.

As for the proportion of each compensation, given the nature of the Company’s business, in which each business reaches profitability through a variety of processes over many years -- including research and development, manufacturing process development and market development -- annual compensation consists primarily of basic compensation, with a general guideline of about 30% for performance-based compensation. And incentive compensation (performance-based compensation and restricted stock compensation) accounts for approximately 40% of total compensation including restricted stock compensation.

In addition to these forms of compensation, an amount that is considered appropriate may be paid as a bonus upon resolution of the General Meeting of Shareholders.

Note that outside Directors, whose position is independent of business execution, are paid only fixed basic compensation.

Annual officer compensation is determined by the Board of Directors upon comprehensive consideration of Company performance, common standards and employee salary trends, and so forth, and after consultation with the Compensation and Nominating Committee. In addition, allocation of individual compensation is entrusted to the President by the Board of Directors, based on the determination that the President is the most suitable person to evaluate each Director while having a highlevel view of the Company as a whole. The President makes these decisions based on discussions regarding the allocation of compensation by the Compensation and Nominating Committee.

The above policies are decided upon by the Board of Directors after consultation with the Compensation and Nominating Committee, comprised of a majority of outside Directors.

Compensation to Audit & Supervisory Board Members

Compensation to Audit & Supervisory Board Members consists only of a basic compensation amount within a range stipulated by the General Meeting of Shareholders, which is determined through deliberations by the Audit & Supervisory Board Members.

| Position | Total Amount of Compensation (millions of yen) |

Total Amount of Compensation by Type (millions of yen) | Number of People Receiving Compensation | ||

|---|---|---|---|---|---|

| Basic | Performance | Restricted Stock | |||

| Directors (excluding outside Directors) |

499 | 311 | 136 | 50 | 9 |

| Audit & Supervisory Board Members (excluding outside Audit & Supervisory Board Members) |

54 | 54 | - | - | 2 |

| Outside Officers | 78 | 78 | - | - | 7 |

| Total | 632 | 444 | 136 | 50 | 18 |

Note: The amount of restricted stock compensation for Directors indicated above is the amount reported as an expense relating to restricted stock compensation for the current fiscal year.

Hostile Takeover Defense Plan

At present, MGC has not established a hostile takeover defense plan.