Financial/Performance Highlights

Overview of Results for FY2024

In the fiscal year ended March 31, 2025, the global economy benefited from a gradual recovery trend on the back of a slight moderation in inflationary pressure. On the other hand, financial and capital market conditions, such as foreign exchange rates, remained highly volatile due to the impact of such factors as changes in U.S. government policies following the presidential election and shifts in monetary policies undertaken in the United States and major European countries. Meanwhile, the Chinese economy remained stagnant, while prolonged conflicts in the Middle East as well as the ongoing Russia-Ukraine War continued to fuel geopolitical risks. Furthermore, due to the impact of tariff measures invoked by the United States, the global economy became increasingly exposed to policy risks. Together, these factors gave rise to persistent concerns about the further decoupling of economies and supply chains worldwide.

Against this backdrop, the gradual economic recovery around the globe helped drive a year-on-year recovery trend in overall product demand for the Mitsubishi Gas Chemical (MGC) Group. However, the business environment surrounding the Group remained quite uncertain due to such negative factors as a delayed pace of recovery in semiconductor market demand—except in the area of advanced materials—and the prolongation of China’s economic stagnation.

Over the course of the fiscal year ended March 31, 2025, the MGC Group has pursued the new target of “Strengthening the resiliency of our business portfolio” under a medium-term management plan launched at the beginning of said fiscal year. Specifically, the Group has been pushing ahead with various measures with such themes as “Focusing on Uniqueness & Presence,” “Building new value through innovation,” and “Restructuring businesses requiring intensive management.” In this way, we have been thoroughly implementing business portfolio reforms that are directly aimed at improving capital efficiency.

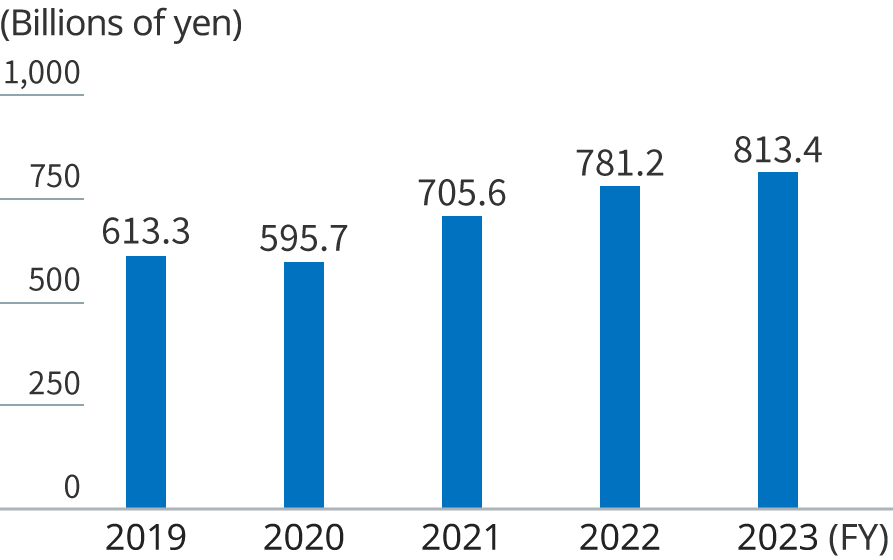

Due mainly to the December 2023 transition of JSP Corporation from consolidated subsidiary to equity-method affiliate, the Group’s net sales decreased despite the depreciation of the yen, higher methanol market prices, growth in sales volumes of such products as optical materials for smartphone use, and other positive factors.

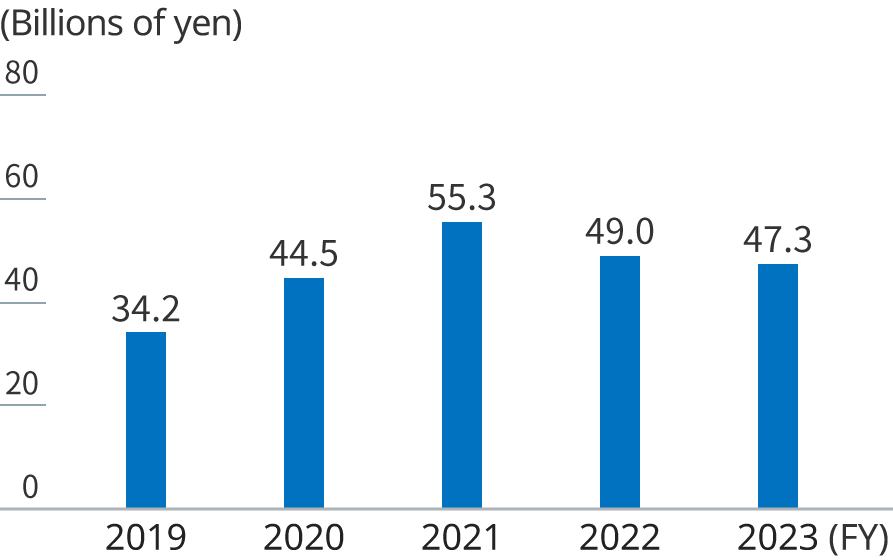

Operating profit increased despite such negative factors as the aforementioned transition of JSP Corporation to equity-method affiliate. This increase was mainly attributable to year-on-year growth in earnings from such engineering plastics as polycarbonate and polyacetal, optical materials, and the methanol business. Other factors contributing to higher operating profit included the depreciation of the yen.

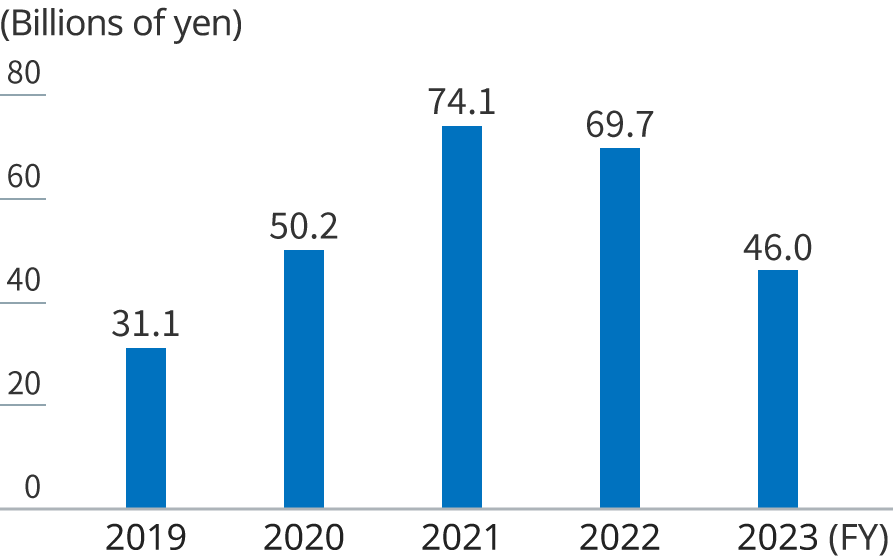

Ordinary profit rose due to the increase in operating profit and improvement in equity in earnings of affiliates. The latter was mainly attributable to the absence of impairment losses recorded at overseas methanol producing companies in the Republic of Trinidad and Tobago in the previous fiscal year, and higher methanol market prices.

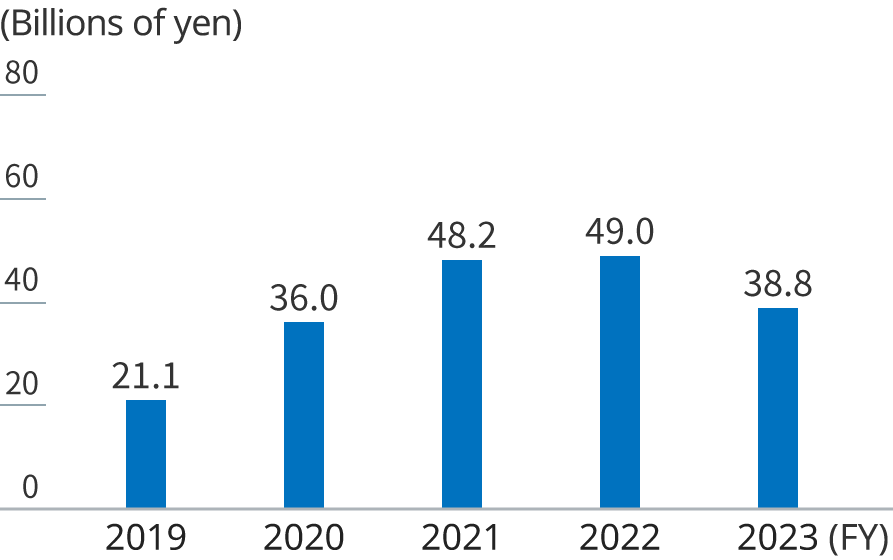

Profit attributable to owners of parent increased despite being negatively affected by the absence of gain on step acquisitions recorded in the previous fiscal year in connection with the inclusion of Mitsubishi Engineering-Plastics Corporation into the scope of consolidation. This increase was mainly due to higher ordinary profit and a temporary improvement in income tax―deferred, the latter of which resulted from changes in the Group’s classification of deferred tax assets in terms of recoverability.

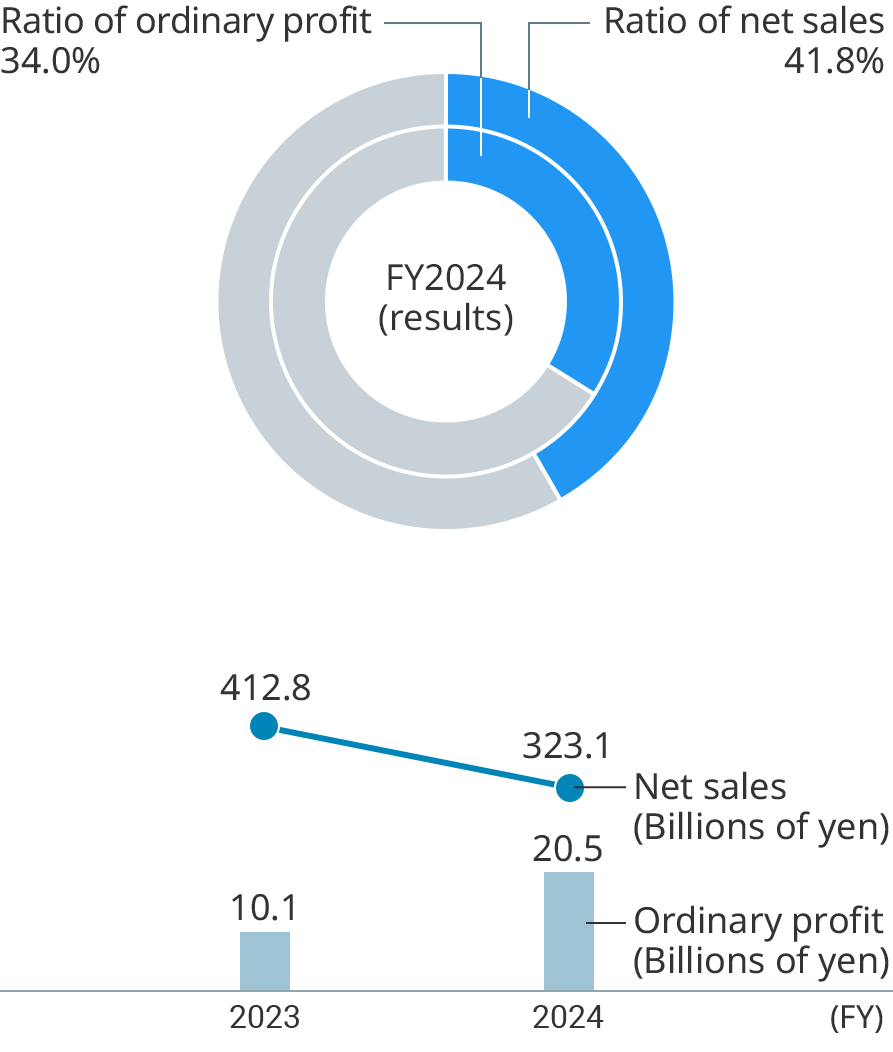

Results by Business Segment

Green Energy & Chemicals

- ※ Pie charts exclude other operations and adjustments.

- ※From fiscal 2024, the Basic Chemicals Business Sector has been renamed as the Green Energy & Chemical Business Sector due to an organizational change.

- ※Net sales presented for each reportable segment in the subsequent section, “Results by Business Segment,” previously comprised only revenues from external customers. However, from the beginning of the fiscal year ended March 31, 2025, the Company revised the method of presentation in this section to include both revenues from external customers and transactions with other segments in net sales for each such segment. Moreover, segment net sales for FY2023 have been presented by retrospectively applying the above change.

The methanol business saw increases in both net sales and earnings due primarily to the absence of impairment losses recorded at overseas methanol producing companies in the Republic of Trinidad and Tobago in the previous fiscal year, in addition to year-on-year rises in methanol market prices.

Methanol and ammonia-based chemicals posted a decrease in earnings despite the recovery trend in the sales volume of MMA products, due to higher repair costs and other negative factors.

The energy resources and environmental business saw increases in net sales and earnings due primarily to the higher sales volume of LNG for power generation use, along with growth in the sales volume of iodine and rising market prices for this offering.

Meta-xylenediamine and aromatic aldehydes recorded a decrease in earnings, reflecting such factors as the lower sales volume of derivatives for China-bound exports and higher fixed costs, despite a recovery trend in demand for products targeting European and U.S. customers.

Xylene separators and derivatives posted increases in both net sales and earnings, despite stagnant market prices for purified isophthalic acid, thanks to the depreciation of the yen and other positive factors.

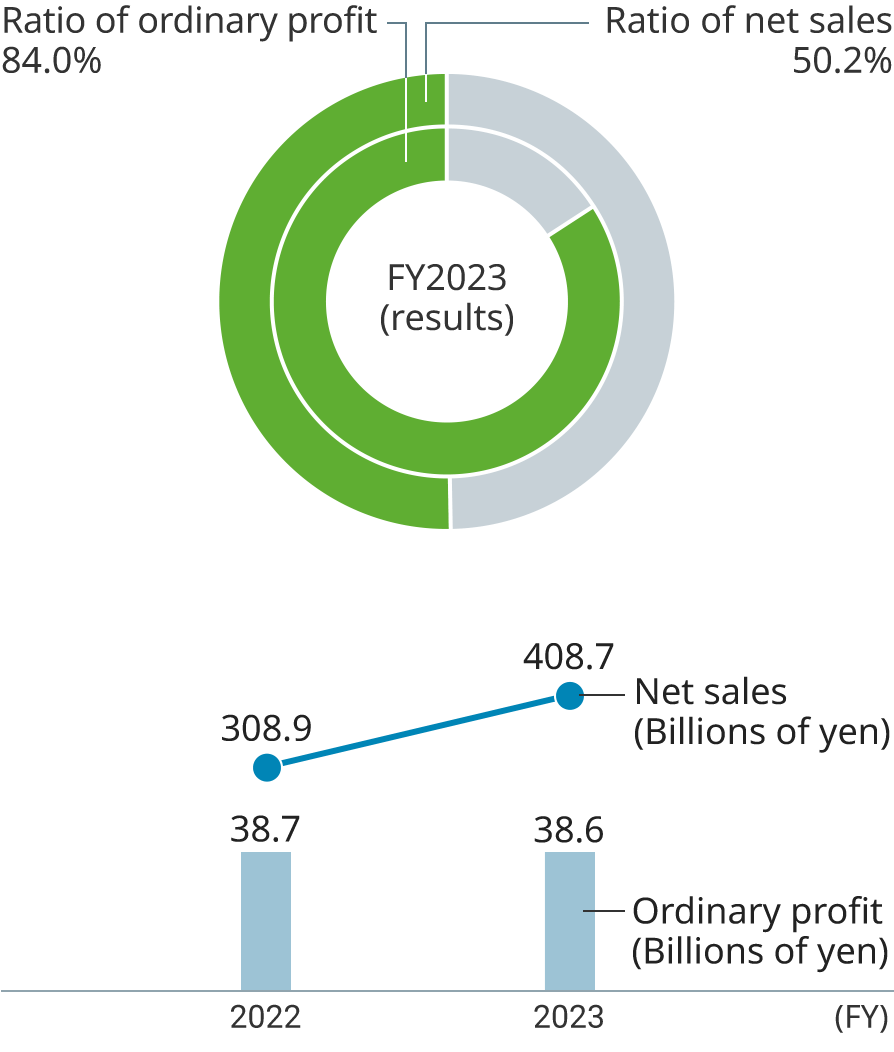

Specialty Chemicals

- ※ Pie charts exclude other operations and adjustments.

- ※Net sales presented for each reportable segment in the subsequent section, “Results by Business Segment,” previously comprised only revenues from external customers. However, from the beginning of the fiscal year ended March 31, 2025, the Company revised the method of presentation in this section to include both revenues from external customers and transactions with other segments in net sales for each such segment. Moreover, segment net sales for FY2023 have been presented by retrospectively applying the above change.

Inorganic chemicals, which include those for use in semiconductor manufacturing, posted an increase in earnings, reflecting growth in the sales volume of hybrid chemicals and other products for use in the manufacture of highly functional memory devices.

Engineering plastics saw increases in both net sales and earnings due to growth in sales volumes of polycarbonate and polyacetal products, especially those with high-value-added applications, in addition to improvement in manufacturing costs, and other factors.

Optical materials posted increases in both net sales and earnings on the back of a higher sales volume of optical polymers that reflected a trend toward increasingly sophisticated smartphone camera functions, growing demand for products targeting emerging nations, and other factors.

Electronics materials posted earnings on par with the previous fiscal year. Despite such positive factors as robust sales of BT materials for smartphone-related IC plastic packaging—the core product category for electronics materials—and growth in the sales volume of OPETM substrate material for AI servers, earnings remained flat due to higher costs for strengthened quality management measures implemented for customers of BT materials and other negative factors.

Oxygen absorbers such as AGELESSTM posted increases in net sales and earnings due to improvement in export prices on the back of the depreciation of the yen, and a higher sales volume of products for overseas customers.