Response to Climate Change(Disclosure Based on the TCFD Recommendations)

In May of 2019, MGC declared its support for the recommendations of the Task Force on Climate-related Financial Disclosures (the "TCFD").

Tackling climate change is a major challenge that calls for initiatives on a global scale if we are to achieve a sustainable society. MGC recognizes that solving energy and climate change problems is an important issue, and is working to solve these issues in terms of both mitigating and adapting to climate change.

Specifically, MGC has formulated targets for reducing Scope 1 and 2*1 greenhouse gas (GHG) emissions and is working toward their steady reduction. At the same time, MGC is proactively disclosing information on Scope 3*2 GHG emissions and is taking action to reduce them in collaboration with its suppliers. MGC is working to improve energy efficiency and the carbon cycle of raw materials, and to promote energy transition toward the goal of achieving a zero-carbon society by 2050. MGC will also contribute to solving energy and climate change problems through business operations by deploying innovative process technologies and factoring whole-lifecycle GHG emissions into its design and development processes.

In March 2021, MGC announced a new objective for achieving carbon neutrality by 2050 with the goal of limiting the increase in average temperature to below two degrees Celsius. MGC encourages the building of energy systems to achieve carbon neutrality, and aims to expand the range of products conducive to carbon neutrality.

- *1 Scope 1 emissions are GHG emissions directly generated by MGC. Scope 2 emissions are indirect GHG emissions associated with the use of energy (mainly electric power) purchased from external suppliers.

- *2 Scope 3 emissions are indirect GHG emissions generated in supply chains through organizational activities such as raw material sourcing, manufacturing, distribution, sales and waste disposal.

1. Governance

The Sustainability Promotion Council, composed of directors and chaired by the President, deliberates and makes decisions on addressing climate change risk and other key Sustainability issues (materiality). Important matters to be deliberated at the Sustainability Promotion Council is resolved by the Board of Directors.

The participation of corporate sector heads on the Sustainability Promotion Committee, an advisory body to the Sustainability Promotion Council, ensures key Sustainability issues are adequately deliberated.

To develop a response to climate change, MGC has established the Carbon Neutrality Promotion Technical Committee, a Sustainability Promotion Expert Committee that advises the Sustainability Promotion Committee. As the administrative office for dealing with TCFD and CDP requirements, the Climate change Action Technical committee promotes cross-business initiatives.

Long-term objectives for reducing GHG emissions have been incorporated in the Medium-Term Management Plan, with management taking a leading role in their implementation.

2. Strategy: Responding to Climate Change Risks and Opportunities

Assumptions behind scenario analysis for physical risks fiscal 2025

- Evaluation period: July to December 2024

- Evaluation point: 2030, 2050

- Scenario: Global warming

Main external information referenced in the 2°C scenario- -SSP1-2.6 (RCP2.6): A world where global decarbonization progresses, and the average global temperature increase by 2100 is limited to 1.5-1.8°C above pre-industrial revolution average.

- Main external information referenced in the 4°C scenario

- -SSP5-8.5: A world where the global community fails to implement climate measures, and CO2 emissions double by 2050, resulting in a 4.4°C increase in average global temperature by 2100 above pre-industrial revolution average.

- Analysis subjects: 52 sites of the Mitsubishi Gas Chemical Group in Japan and overseas

- The increased risk of weather disaster due to climate change is evaluated as the potential for damage to the Company’s business sites based on published hazard information and material provided by external experts.

- Weather disasters subject to evaluation: river flooding and storm surges

- Main information used in screening evaluation to ascertain the potential for damage to business sites: Ministry of Land, Infrastructure, Transport and Tourism’s “Web-Based Flood Simulation Search System at an Arbitrary Point ” and Fathom Global Flood Map

- Change from the FY2021 physical risk analysis: Changed from the highest hazard level (flood depth 2m: our own criteria) to the second highest level (flood depth 0.5m: Ministry of Land, Infrastructure, Transport and Tourism criteria). The scope was changed from a people-centric evaluation to one that also considers buildings and facilities.

- Main information used for quantitative evaluation of companywide financial impact amount of climate change for business sites evaluated to have a high level of hazard under the screening results: evaluating organization’s flood damage calculation model and the Ministry of Land, Infrastructure, Transport and Tourism’s “Manual for Economic Evaluation of Flood Control Investment (Draft) ”

Results of Physical Risk Assessment

| Type of weather disaster | Number of business sites evaluated as highly hazardous※1 | ||||

|---|---|---|---|---|---|

|

Under current climate |

2°C scenario | 4°C scenario | |||

| 2030 | 2050 | 2030 | 2050 | ||

| River flooding | 12 | 12 | 12 | 12 | 13 |

| Storm surge | 2 | 3 | 3 | 3 | 3 |

| Economic impact amount (Millions of yen)※2 | |||||

| River flooding | - | 10 | 130 | 30 | 300 |

| Storm surge | - | 10 | 60 | 10 | 70 |

※1:Determination standard=Ministry of Land, Infrastructure, Transport and Tourism standard grade B and above

※2:Economic impact amount=Cumulative value of the sum of physical damage amount and opportunity loss amount from 2024 to the time of evaluation

3. Risk Management

MGC has identified key issues (materiality) related to the environment, society and governance, and manages risk through cross-company materiality management. One material issue that has been identified as extremely important from the perspective of stakeholders and MGC itself is a proactive response to environmental problems. MGC intends to take the initiative on this issue, a requirement for continuing our business operations and activities.

Under this scenario analysis, the result showed that the financial impact of climate change on the MGC Group is limited. Analyzing this result, we found that the reason is that the Group’s business sites are generally not subject to high hazard risk due to the characteristics of their locations. However, we will conduct a more detailed analysis on the sites evaluated as highly hazardous as necessary going forward, and also strengthen our business continuity planning (BCP), while proceeding with measures such as developing multiple manufacturing sites, optimizing raw material and product inventories throughout the supply chain, and reducing equipment stoppage risk.

To gain a quantitative understanding of climate change risks, in April 2021 MGC introduced an internal carbon pricing system. In capital investment plans involving an increase or decrease in CO2 emissions, the cost or effect of applying and converting the internal carbon price (10,000 yen/MT-CO2 equivalent) will be used to help make investment decisions, promote CO2 emissions reductions, and encourage the creation of technologies and products that contribute to building a low-carbon society.

4.Metrics and targets

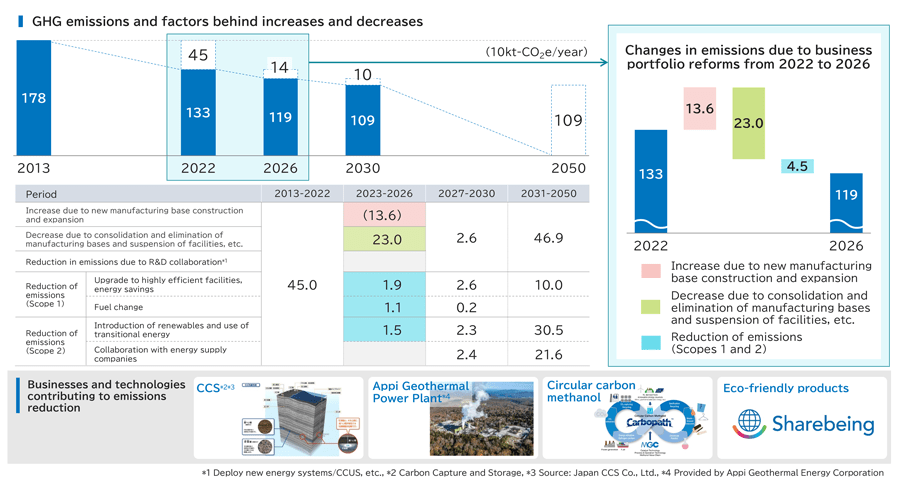

MGC group has established long-term objectives for reducing GHG emissions as it works toward achieving carbon neutrality by 2050. To achieve these objectives, MGC has established key performance indicators (KPIs) for GHG emissions and GHG emissions intensity. We are moving forward with short, medium and long-term emissions reduction strategies that include promoting energy savings activities, deployment of renewable energy, and Circular Carbon Methanol production.

Long-term GHG Emissions Reduction Targets

-

2026 target:

33% reduction from FY2013 baseline -

2030 target:

39% reduction from FY2013 baseline -

2050 target:

carbon neutrality